Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Insurance is a growing but still under-penetrated sector in Nigeria. As more people and businesses seek financial protection and risk management.

Interestingly, some insurance companies stand out for their performance, trust, product diversity, and innovation.

However, others are still struggling to climb the ladder.

Below are ten of the strongest insurance companies in Nigeria right now, followed by what I believe could makes a difference (and what others must do to catch up).

These companies offered flexible and modern products tailored to meet your current and future needs.

products such as;

6. Corporate Business Insurance

7. Investment-linked Life Plans

10. Goods-in-Transit

12. Life Assurance

These top insurance companies are ranked by what they do well. Also, what to watch out for or where they can improve

ALSO READ; How to build wealth through insurance investment in Nigeria

AIICO was established since the 1960s; strong in both life & general insurance. They lead in premium income and have shown steady growth in recent years.

Sometimes customer service and claims-settlement times lag expectations. Also, digital tools are improving but could be more intuitive.

Leadway is highly rated for financial stability, product diversity (life, health, auto, investment-linked), good market share.

Their brand is trusted. Premiums can be relatively high; some clients find pricing less competitive for certain general insurance products.

Also, some rural or smaller markets are less well served.

Custodian is strong in general insurance, marine, property, corporate risks. Good reputation among businesses. Less known for life insurance among the general public.

Could improve branding for its life/personal lines. Sometimes premium payment and renewal processes are seen as cumbersome.

AXA Mansard brings international expertise via the AXA group; strong in health (HMO), travel, and personal protection insurance.

Good digital adoption. As with many large firms, bureaucracy sometimes slows claim processing.

Also, some customers report that for niche products, flexibility is limited.

NEM impressive growth in recent years; good for general lines like fire, marine, aviation. Competitive pricing and industrial capacity.

Their customer outreach in smaller towns is less strong; claims transparency in some cases needs improvement.

They also have to maintain financial reserve levels consistently to handle large industrial claims.

Mutual Benefits Assurance is good for micro-insurance, life, and personal insurance. Growing presence, especially in less saturated markets.

Because they serve many lower-premium clients, risk pooling and claim sustainability can strain resources.

Needs continuous investment in risk assessment and fraud control.

Cornerstone Insurance is noted for travel, auto, tech-driven product design. Customer experience often praised. Market share is smaller compared to the big five.

May struggle with large corporate or industrial risk underwriting. Also, scaling operations (especially claim processing) will test their systems.

Coronation Insurance shows technological innovation; growing in both life and general lines. Good among customers who prefer modern interfaces and policies.

Brand visibility is less than older firms. Also, the margin for error in pricing and underwriting is tighter in competitive segments.

Some products may have limited coverage or restrictive terms.

Sovereign Trust is known for responsive service, competitive pricing among mid-tier clients, dependable for general insurance policies.

Their brand is less visible in life insurance / pensions. Also, their digital presence (apps, online support) still lags behind the top companies.

Lasaco is one of the long-standing companies; good for general insurance; stable track record. Recognized regionally.

Less diversified in terms of life / investment-linked products. Also, revenue growth has been modest relative to some high-growth peers.

They could benefit from streamlining operations and improving claim turnaround times.

From studying these companies and talking to consumers, here are some of the most important factors influencing why people choose one insurer over another—and why some succeed more than others:

No matter how cheap a premium is, if a policyholder cannot trust the insurer to pay out when needed, or if claim processes are slow, reputation suffers.

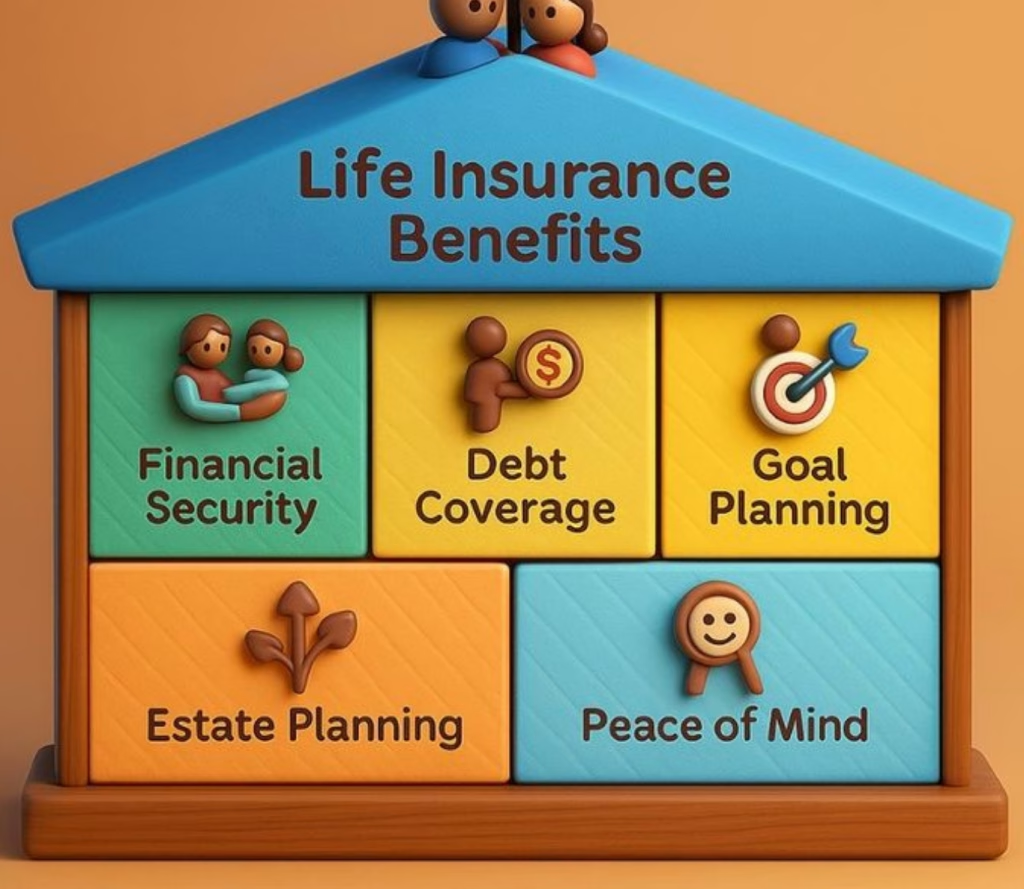

A firm that offers both life AND general insurance (auto, health, fire, etc.), as well as customizable add-ons (like riders, optional coverage) tends to attract more customers.

Apps, online policy management, digital claims filing, chatbots, responsive support — these are increasingly expected. Insurers investing in technology are gaining edge.

Firms that are available not just in Lagos/Abuja but also in smaller cities and rural areas are expanding penetration. Micro-insurance is also an area with potential.

Especially in sectors like agriculture, marine, or industrial risks, the ability to pay large claims depends on having strong reserves, prudent investment, and good re-insurance.

There’s a balance: premiums must be competitive, but too low can compromise the ability to pay claims or maintain service quality.

Companies that are well-regulated (by NAICOM), transparent in their disclosures (turnover, claims, solvency), and maintain public trust (through ethical practices) fare better in the long term.

I weighted recent financial performance (premium income, growth) more heavily than name or age alone. A company with high turnover but poor client service may lose out in perception and retention.

I also considered customer ratings / reviews as a tie-breaker when financials are close.

I emphasized innovation and expansion, because for many Nigerians, ease of dealing (online, mobile) now matters as much as price.

Always check claim settlement history — how quickly and fully past claims have been paid. If possible, ask peers who have used the company.

Compare terms & exclusions. Sometimes “cheaper” policies exclude major or likely risks. What looks good on paper may leave gaps.

Review the financial strength and reputation of the insurer. Public disclosures, audited reports, or regulatory rating are good sources.

For businesses or high-value assets, ensure the insurer has experience handling large industrial or commercial risks.

Don’t overlook local presence: an insurer with local branches near you or strong networks (e.g. garages for auto, hospitals for health) makes claims handling easier.

The Nigerian insurance sector is evolving fast. Growth in middle-class incomes, increasing awareness of risk (e.g. health, climate events, business risks), plus regulatory push, are creating opportunity. But challenges remain: low insurance penetration, trust deficit, insufficient consumer education, and varying regulatory enforcement.

I believe the top firms listed above will continue to do well—especially those that keep investing in tech, transparency, and customer service. But there’s room for disruption. A newcomer that offers excellent mobile service, clear claims, affordable premiums, and addresses underserved areas could make a serious dent.

[…] ALSO READ; Nigeria’s leading insurance companies […]